The field of economics, ever since its foundational inception in the late 18th century, has always been in the crosshairs of scholarly criticism based on the core notion that it only values ‘money’ and ‘utility’ in a shareholder capitalistic model. The foundational theory of economics, the ‘utility theory’ proposed a framework that analyses individual economic decision making in the context of fixed utility (happiness and satisfaction) derived from consuming goods and services [1].

What is Behavioral Economics

The concept of fixed utility in economics remained largely unchallenged until the 1970s when social scientists began to interrelate the concepts of utility and individual consumer behavior by taking into account the cognitive biases and social factors that influence economic decisions. The merger of the two fields resulted in the formulation of an entirely new field of economics termed as ‘Behavioral Economics’. Most recently, the term Neuroeconomics [2] has also been used for behavioral economics.

The bedrock of behavioral economics is the Prospect Theory [3] postulated by Daniel Kahneman and Amos Tversky in 1979 in their famous paper titled ‘Prospect Theory: An Analysis of Decision under Risk’[4]. This scholarly article is the most cited paper in the fields of economics and psychology till date (78,110 citations as per Google Scholar) [5].

What is Prospect Theory

Prospect theory states that both economic and social decisions involving risks and uncertainty exhibit several pervasive effects that are inconsistent with the tenets of utility theory. Prospect theory derives its scientific explanation from a bias in human decision-making apparatus – The Certainty Effect.

The Certainty Effect

The certainty effect postulates that humans overweigh the outcomes that are considered certain relative to outcomes that are considered mere probable.

Let me give you a quick example to elucidate the certainty effect.

You are given the following 2 choices for investment. Which one will you select under normal circumstances?

Option 1:

Invest $1000 in 3 assets with each asset having a risk and a probability of loss. Your expected return will be:

$2,500 with probability of 33%

$2,400 with probability of 66%

$0 with probability of 1%

Option 2:

Invest $1,000 in one asset only and get a certain return of $2,400.

The actual data showed that 82% of the respondents choose the 2nd option not realizing that both investment options will actually yield the same exact return (In option A, if you multiply the expected return with the probability and sum it, it will yield a return of $2,400). The 82% referred certainty over probability.

What factors do we Consider while making Decisions

The decision-making apparatus, over a long period of evolution, has hard coded this bias in our thinking process. Resultantly, we make decisions by taking into consideration the following aspects.

1. Out perception of value is linked to relative change and not absolute change

You lose $1000 and your friend gains $1000, however, at the end of this transaction, net worth of both of you stand at $10,000. You will ‘feel’ worse off despite being at the same level of net worth.

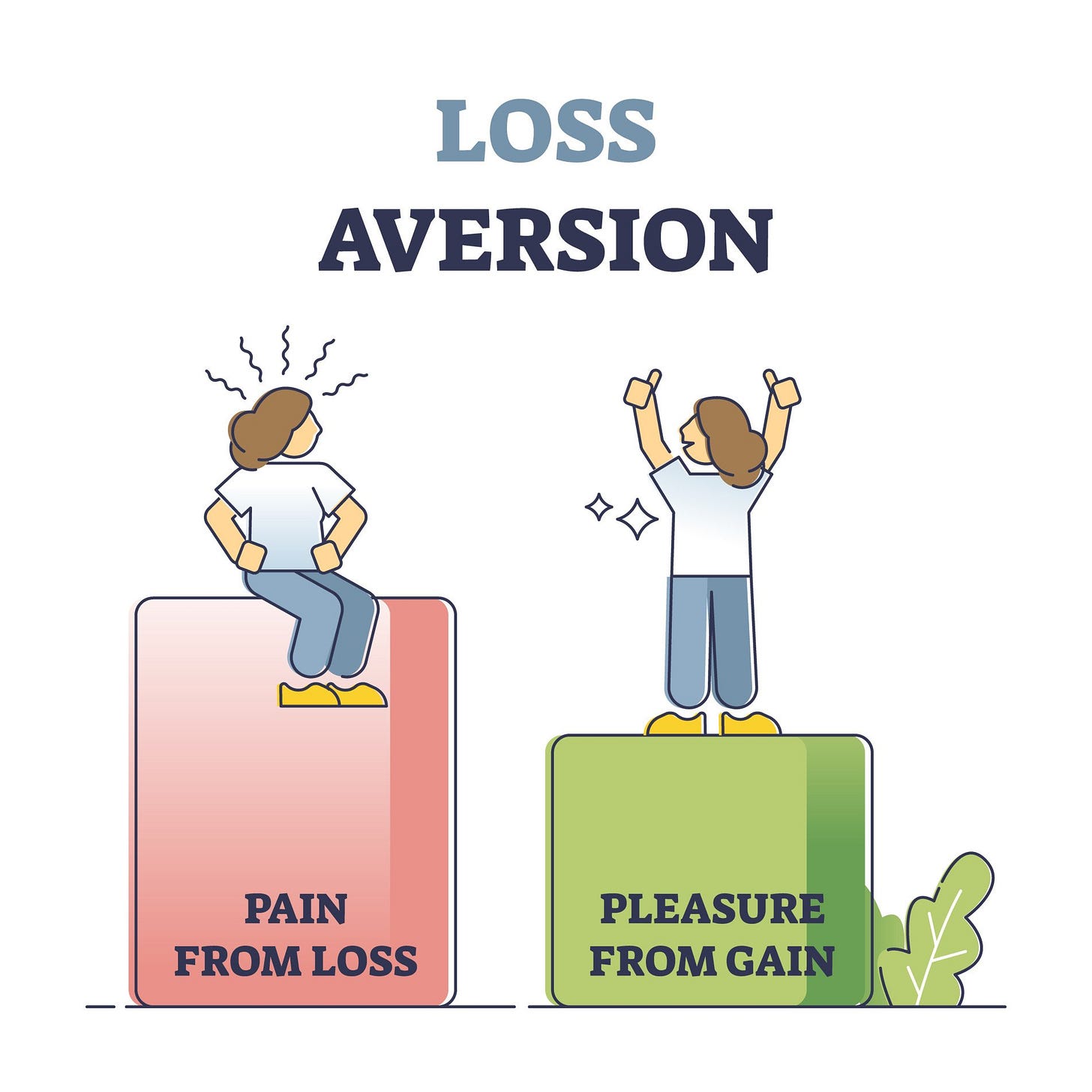

2. We are much more sensitive to losses and gains of the same magnitude.

The displeasure from losing $100 is worse than pleasure from gaining $100.

This bias in our decision-making process manifests itself in manifold ways in the everyday life.

We as humans, avoid the situations where there is a high probability of something going wrong. For example, majority of people avoid changing their immediate environment despite being in worse situation because they fear that the change may worsen off the current situation.

We also avoid (Read: Hate) situations where probabilities are involved despite knowing the fact that the most probable outcome will still be beneficial for us or will at least be at par with the certain outcome.

We will only take risks in situations when we perceive the gains from taking risk far outweigh the losses arising from the outcome.

I certainly hope that while making your next decision (either economic or social), you take a more rational approach by weighing in the losses and gains and quantifying them. Even though we prefer the gains, history bears testament to the fact that those whose names remain till date were the ones who ventured into the unknown without any fear of loss.

Sometimes it takes more than certainty to build a better future. More specifically, it requires belief in one’s abilities and the hope for this better future.

I hope you learned something new today.

Thanks for reading.

Best Regards,

Irfan Rashid

References:

1: https://www.jstor.org/stable/2628674

2: https://camerergroup.caltech.edu/

3: https://paulcohen.com/the-key-implications-of-prospect-theory/

5: https://www.jstor.org/stable/1914185